EMERGENCY LEGISLATION

Laws are being passed very quickly, are being interpreted by multiple agencies, and policies written by the Treasury Department and Department of Labor on an ongoing basis. Changes in the regulations will be frequent and PCS will attempt to keep the information updated as soon as it happens. This page covers:

- The Coronavirus Aid, Relief And Economic Security (CARES) Act (which includes info on the Payroll Protection Program and the Emergency Economic Injury Disaster Loan (EIDL), and

- The Families First Coronavirus Response Act FFCRA

- Updates will be made frequently and a list of the most recent updates can be found here.

LATEST UPDATES

The following is a running summary of clarifications, changes and guidance related to the FFCRA and CARES legislation. We will only use information verifiable from a government regulatory agency. Our sources include:

- congress.gov/H.R.6201 – Families First Coronavirus Response Act

- congress.gov/H.R.748 – CARES Act

- sba.gov/PPP Interim Final Rule

- sba.gov/PPP Affiliation Interim Final Rule

- treasury.gov/PPP Information sheet

- novitas-solutions.com

- treasury.gov/PPP Frequently Asked Questions

- sba.gov/ PPP Frequently Asked Questions

- treasury.gov/PPP – Additional Eligibility Criteria and Requirements for Certain Pledges

- congress.gov/H.R.7010 – Paycheck Protection Program Flexibility Act of 2020

- TWC.texas.gov/twc–acceptable-reasons-work-refusal

- sba.gov/Paycheck-Protection-Program-Frequently-Asked-Questions

- sba.gov/Forgivenss

Latest Updates

- For PPP loan, you must have been in business prior to February 15, 2020 (CARES said that, update confirms).

- For EIDL loan you must have been in business prior to January 1, 2020.

- EIDL application with emergency grant period is to December 31, 2020 – NOT June 30, 2020 like the PPP loan.

Clarified that calculation of the PPP loan amount is based on the twelve-month period prior to your application OR the twelve month period in the prior calendar year (borrower choice).FURTHER CLARIFICATION ON QUESTION 14.- Clarified/changed CARES language that 1099 wages paid by employer cannot be included in payroll for PP loan.

- Any EIDL funds procured PRIOR TO APRIL 3, 2020 may be included in the PPP loan amount. No clarification on how that effects your forgiveness amount.

- Interest on PPP loan amount will be 1% for not more than 5 years (second change in a week). Still no pre-payment penalty.

- PPP loan amounts NOT forgiven MUST be used for the same applicable expenses allowed for original loan use. Using them for other purposes considered fraud.

- EIDL grant amount is NOT $10,000 – due to “higher than expected requests” it has been changed from CARES language to $1,000 for each employee up to a maximum of $10,000.

- If you take out a PPP and an EIDL, the up to $10,000 grant is NOT free but deducted from the PPP loan forgiveness amount – which means it becomes a loan at 1%.

- ADP posted that you could include FICA in your PPP loan calculation…this continued for days despite any confirmation from SBA. On April 7 they rescinded this stating SBA changed it again. In our opinion it never was right. This is a good example of why you should not believe things without back up from government guidance.

- Certain Medicare MACS are distributing information regarding applying to the Medicare Accelerated and Advanced Payment benefit. Some are specifying forms you need to use. Check with your local MAC for correct application information.

- On April 8, 2020, SBA met with the banking industry to scold them for the delays in loan applications and processing. The April 8, 2020 Treasury Department guidance once again states that the CARES Act directed the lending industry to act in an expedient manner by: allowing lenders to develop their own systems and protocols; allowing lenders to ignore some of the more stringent traditional SBA loan protocols; removing lender liability for loan information accuracy as long as they conduct a “good faith effort” in reviewing claims but allowing total reliance on information provided by the borrower including borrower information regarding multiple location affiliation rules; and, federally insurance the loans at 100%. It is expected the lending activity will increase sharply.

- Treasury Department guidance gave more options for the loan determination period for PPP loans. When calculating payroll and other applicable expenses for the maximum PPP loan amount, borrowers, at their choice, may choose the twelve-month period prior to the loan application OR the calendar year 2019. They may also elect to use either time period when calculating their number of employees.

- Treasury Department guidance once again confirms the eight-week loan spending period begins on the date the loan funds are disbursed to the

lenderborrower. The lender is required to disburse the funds to the borrower within ten days of disbursement from the SBA. - We are hearing very creative ways you are allowed to spend your PPP loan money during the eight-week period. PCS advice is to be very careful in making these decisions unless you are willing to take on any potential un-allowed amounts as a 1% loan.

- Specific guidance regarding how to apply for PPP loan for partnerships, sole proprietors and independent contracts was released on April 14, 2020. The details can be found in the PCS section on PPP loans.

- On April 23rd, congress approved a bipartisan deal to push more than $300 billion in new funds into the Payroll Protection Program. Congress set aside $30 billion specifically for smaller businesses trying to get PPP. The bill also provides $50 billion for the SBA’s EIDL loan program and another $10 billion for EIDL advanced grants, which had both run dry. There was also $75 billion of new money into the same fund that was used to provide HHS emergency relief grants to doctors of optometry and other Medicare-enrolled physicians.

- The second round of HHS Provider relief funds began being disbursed on April 24. Providers who receive funds have to sign an attestation confirming receipt of funds and agree to the terms and conditions of payment.

- Due to overwhelming demand, the SBA has decreased the disaster-loan limit from $2 million to $150,000, and is not accepting new applicants (except agricultural).

- See the Payroll Protection Program section below for significant, recent changes in how the forgiveness program works.

CORONAVIRUS AID, RELIEF AND ECONOMIC SECURITY (CARES) ACT

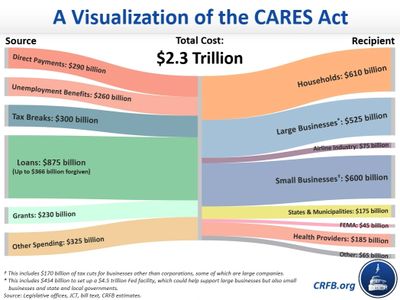

The recently passed Coronavirus Aid, Relief and Economic Security (CARES) Act provides $2 trillion in emergency aid to businesses and individuals impacted by the COVID-19 crisis. The 880-page legislation is very complex. The content below is our best explanation and has been divided into the basic parts of the Act:

- Small Business Loan Program Expansion 7(A) (which includes the Payroll Protection Program, the SBA Express Loan, and Emergency Economic Injury Disaster Loan (EIDL) Grants)

- Employee Issues and Business Assistance

- Changes in Health Care Delivery

- Provider Relief Fund

- Student Loan Relief

- Individual Assistance Programs

Each business owner should consider consultation with legal, human resource and accounting professionals before taking significant actions.

SMALL BUSINESS LOAN PROGRAM EXPANSION 7(A)

Overview

The programs are funded through private financial institutions that can pay directly to approved applicants. Approval is based almost entirely on documentation the business was operational on February 15, 2020 and had employee expenses but specific eligibility is noted for each program. Specific questions can be directed to your local SBA office

PAYROLL PROTECTION PROGRAM

Payroll Protection Program Overview

In general, this program is designed to help you retain your employees in the economic downturn related to the COVID-19 crisis by providing federally guaranteed loans that are forgiven, with stipulations, if you continue to pay your employees.

Key Elements

The key elements of this loan are as follows

- Applies to most businesses with less than 500 employees (optometry practices included)

- Includes sole proprietors and independent contractors (not to exceed $100K during the covered period). Benefits are also available to most franchise owners (waiver of affiliation rule – more information can be found here)

- You must have been in business prior to February 15, 2020

- You may apply for this loan at any time up to December 31, 2020

- Loan amounts are tied to the business’ payroll costs and certain operational costs with a maximum of $10 million.

- Determination of loan amount is based on:

- If you were in business February 15, 2019 – June 30, 2019: The maximum loan amount is 2.5 X your average monthly payroll costs (defined below) for the twelve-month period prior to your application for the loan

- If you were NOT in business February 15, 2019 – June 30, 2019: The maximum loan amount is 2.5 X your average payroll costs (defined below) for the period January 1, 2020 – February 29, 2020.

- NOTE: Additional guidance provides more options regarding the covered period for loan amount determination.

- For this program, payroll costs are defined as:

- All wages, salaries and commissions (any employee receiving a W-2 may be counted but high wage earners applicable wages limited to $100,000) NOTE: As of April 3, 2020, SBA ruling states that independent contractors may not be counted in the owner’s payroll. Independent contractors, sole proprietors, and general partners are allowed to file for their own PPP loan.

- Vacation, sick, PTO, family, medical or parental leave

- Allowances for termination

- Employer contributions to costs related to group health care benefits including insurance premiums

- Employer contribution to retirement benefits

- Employer contribution to state or local tax assessed on compensation of employees

- Loan amounts (applicable expenses) may be used for payroll, paid sick leave, paid vacation, paid leave under the sick time leave and FMLA extension in Families First Coronavirus Response Act, any state or local taxes on employee compensation, insurance premiums, interest on mortgage, rent and utilities (the applicable expenses).

- Loan forgiveness is based on the applicable expenses during a defined period after origination of the loan compared to a specified period of time in the past year. The forgiveness amount will be decreased by the amount the current expenses are less than the expenses one year ago. The original language on what percent must be used for payroll expenses was changed – see update in Forgiveness Section. Any amount not forgiven will be payable over a period not more than five (5) years at an interest rate of not more than 1.0%. NOTE: The original loan terms of ten years at 4% were earlier changed to two years at 0.5% then changed again April 3, 2020 to two years at 1.0%. They were changed again on June 3, 2020 to five years at 1% interest. See details in Forgiveness Section.

- Any loan forgiveness amount will not be counted as taxable income

- PPP loan amounts NOT forgiven MUST be used for the same applicable expenses allowed for original loan use. Using them for other purposes considered fraud.

- You can only take out one PPP loan but SBA requirement that business not obtain other loans in addition to the SBA loan is waived. See specific regulations for coordination with EIDL loan below.

- Any EIDL funds procured PRIOR TO APRIL 3, 2020 may be included in the PPP loan amount. (No clarification on how that effects your forgiveness amount)

Intent

The intent of this loan is to support ongoing operations including retention of employees and other business obligations but the emphasis is on keeping employees paid. At least during the loan period, there is a major incentive to hire back any employee laid off. If employees are re-hired at initiation of loan, any reduction in forgiveness will be limited to how much your expenses were reduced compared to the prior year period. You may re-evaluate your business’ financial well-being at the end of the loan period and make any adjustments needed to maintain the viability of the practice. NOTE: According to the April 3, 2020 update, If you knowingly use PPP funds for any expense not stated as an applicable expense under this Act, SBA will consider this a fraudulent activity. Also, the June 3, 2020 update provides additional relief regarding the rules related to bringing your employees back to work.

How to apply

Application for an SBA loan is made through most any bank or lending institution. Current SBA lenders can be found here. Application preference will be given to SBA preferred lenders (ask the lender if they are or check them out on the SBA website). Forms for this loan can be found here You will need documentation of all payroll expenses you are claiming. Example calculations and a walk through can be found here.

On March 31, 2020, the Treasury Department issued directions to SBA lenders for CARES loan processing. The banks may begin taking application on April 3, 2020 for most businesses and April 10, 2020 for sole proprietors and independent contractors. On April 2, 2020, new directives were given that have resulted in potential hesitancy by the lender to continue processing loans until they are assured further changes will not be made.

- NOTE: Part of the SBA update on April 3, 2020 allowed lenders up to sixty (60) days to process loans. There was also a statement that loans would be issued on a “first come first served” basis. While this implies to some that once the originally allocated $349 billion dollars is depleted, no more loans will be available. Both the Treasury Secretary and the President have been quoted saying the funds will be replenished but there is no Congressional action at this time. We can only apply logic that the obvious intent was not to serve up loans like a restaurant and when the food is gone everyone starves.

- NOTE: On April 21, 2020, $310 billion dollars was added to fund additional PPP relief.Stay tuned

PPP Loan Guidance for Self-Employed (sole proprietors and independent contractors)

The latest guidance from the Treasury Department (treasury.gov/Eligibility-Criteria-and-Requirements-for-Certain-Loans.pdf) provides additional insight into the mechanics of filing for a PPP loan if you are self-employed. The new guidance is relatively clear is you file your taxes using the standard IRS 1040 form with Schedule C describing the finances of your business. If you are an LLC, PLLC or other partnership, the guidance does not help. In order to apply for a PPP loan, you must have already completed or complete Schedule C of your 2019 tax return.Calculating Your Loan AmountIf you are a sole proprietor or independent contractor who has no employees, you calculate the maximum amount of your PPP loan as follows:

- Look to Line 31 (net profit) on Schedule C. If this amount is under $100,000 record that amount. If this amount is over $100,000 reduce it to $100,000.

- Divide this number by 12 to obtain your average monthly amount (assuming most will be over $100,000 this will be $8,333).

- Multiply the amount in 2 by 2.5 to obtain your maximum payroll amount.

- When you apply for the loan, you will need a copy of your 2019 Schedule C; 2019 1099-MISC showing non-employee compensation; invoice, bank statement or book or record from 2019 showing you were self-employed; and, invoice, bank statement or book of record to establish you were in business on or around February 15, 2020.

If you are a sole proprietor or independent contractor who has employees, you calculate the maximum loan amount as follows:

- Look to Line 31 (net profit) on Schedule C. If this amount is under $100,000 record that amount. If this amount is over $100,000 reduce it to $100,000.

- Find your 2019 gross wages and tips paid to your employees using 2019 IRS Form 941 Taxable Medicare wages & tips (line 5c- column 1) from each quarter plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips. Subtract any amounts paid to any individual employee in excess of $100,000 annualized.

- Find your 2019 employer health insurance contributions (health insurance component of Form 1040 Schedule C line 14), retirement contributions (Form 1040 Schedule C line 19), and state and local taxes assessed on employee compensation (primarily under state laws commonly referred to as the State Unemployment Tax Act or SUTA from state quarterly wage reporting forms).

- Add 1-3 together and divide by 12 to give you your average monthly payroll expenses.

- Multiply the average monthly amount by 2.5 for your total payroll costs amount.

- When you apply for the loan, you will need a copy of your 2019 Schedule C; 2019 1099-MISC showing non-employee compensation; Form 941; invoice, bank statement or book or record from 2019 showing you were self-employed; and, invoice, bank statement or book of record to establish you were in business on or around February 15, 2020. You will also need any applicable state tax documents.

If you are a partner in a general partnership, additional guidance was issued on how you file for PPP relief. You will file only one PPP for the entire partnership.

- For loan amount calculation, use your K-1 distribution amount (line 14a) for 2019. If this amount is over $100,000 reduce it to $100,000 for each partner. Multiply this amount times 0.9235.

- If applicable, add additional employee payroll expenses, employee health insurance and retirement premiums (cannot count partner contributions)

- If the partnership has rent, mortgage interest or utilities, you may add those.

- Divide this number by 12 (months) and multiple x 2.5. This is your loan amount.

What The Loan Proceeds can be used for

The proceeds of a PPP loan are to be used for the following.

- Owner compensation replacement, calculated based on 2019 net profit

- If you have employees, employee payroll costs (as defined in the First PPP Interim Final Rule)

- Mortgage interest payments (but not mortgage prepayments or principal payments) on any business mortgage obligation

- Business rent payments

- Business utility payments

- Interest payments on any other debt obligations that were incurred before February 15, 2020 (such amounts are not eligible for PPP loan forgiveness).

You must have claimed or be entitled to claim a deduction for such expenses on your 2019 Form 1040 Schedule C for them to be a permissible use during the covered period following the first disbursement of the loan (the “covered period”).

What Amounts Are Applicable for Forgiveness

The “rules” of forgiveness are exactly the same as for other PPP loan applicants but there are some differences in what uses can count for forgiveness. These include:

- Payroll costs including salary, wages, and tips, up to $100,000 of annualized pay per employee

- Covered benefits for employees (but not owners), including health care expenses, retirement contributions, and state taxes imposed on employee payroll paid by the employer

- Owner compensation replacement, calculated based on the maximum as calculated for the loan amount.

- Excludes any qualified sick leave equivalent amount for which a credit is claimed under the Families First Coronavirus Response Act (FFCRA)

- Payments of interest on mortgage obligations on real or personal property incurred before February 15, 2020

- Rent payments on lease agreements in force before February 15, 2020

- Utility payments under service agreements dated before February 15, 2020

SBA EXPRESS LOAN

Overview

This is simply a normal SBA loan with financial crisis amendments to allow accelerated turn-around time. The key elements are as follows:

- Maximum loan amount increased to $1 million

- Funds can be used for a variety of business expenses

- Private lenders can supply funds directly

- The loan is NOT forgivable and must be repaid according to standard terms of SBA loans

Apply for an SBA Express loan in the same manner as the PPP instructions above.

EMERGENCY ECONOMIC INJURY DISASTER LOAN (EIDL) GRANTS

This provision expands access to EIDL loans during the COVID-19 crisis. This is a repayable loan under the terms of the SBA but there is a provision for a grant amount of $1,000 for each employee up to a maximum of $10,000 that does not have to be repaid under any circumstances. The key elements of this loan include:

- Available to businesses with less than 500 employees as well as sole proprietors and independent contractors who have been in business since January 31, 2020.

- Low interest loan amounts up to $2 million with potential for principal and interest deferment at the Administrator’s discretion

- Grants will be available January 31, 2020 to December 31, 2020

- Must have been in business prior to January 1, 2020

- Approval based entirely on documentation the business does exist and the applicants credit score (or appropriate alternate method)

- All personal guarantees on loan advance waived

- Provides for release of loan amount up to $10,000 within three days of application

- Any advanced funds released prior to approval of application do not have to be paid back even if the application is denied (unless applicant provides fraudulent information in application)

- Grant funds may be used for payroll, sick leave or FMLA extension costs related to Families First Coronavirus Response Act, increased costs related to the necessity of purchasing products from an alternate source due to interruption in supply chain, rent, mortgage or other business obligation that cannot be met due to disruption in revenue

- According to the April 3, 2020 update, the grant amount ($10K) under EIDL will be subtracted from any forgiveness amount in the Payroll Protection Program. While you can have concurrent PPP and EIDL loans, you cannot use the funds for the same purpose.

How to apply:

You can apply at most banks but also online at https://disasterloan.sba.gov/ela/

EMPLOYEE ISSUES AND BUSINESS ASSISTANCE

Limitations on Small Business Paid Family and Medical Leave

The Treasury Department is authorized to provide qualifying businesses with an advance tax credit equal to expenses paid to provide for sick time or leave time under FMLA extension in the Families First Coronavirus Protection Act. The Treasury Department is allowed to pay the credit directly to the employee in an expedited fashion but does not specify the details of the plan. How the advanced credit will work is not specified but the Secretary of HHS directed to provide instructions.

The provision would also limit employer liability to $5,110 in aggregate for sick leave, $2,000 in aggregate for each employee for leave related to:

- Employee subject to quarantine by Federal or State law

- Employee advised to quarantine by health care provider

- Employee experiencing COVID-19 symptoms and seeking medical diagnosis

The provision would limit employer liability to $200 per day, $10,000 aggregate for each employee for leave related to:

- Employee caring for an individual subject to Federal or State quarantine

- Employee caring for child whose school has closed or childcare is unavailable due to COVID-19

- Employee experiencing substantially similar conditions specified by HHS

It appears the provision would also allow an employee who was laid off after March 1, 2020 but then rehired to have access to COVID-19 paid sick and family leave. If allowed, it is likely the layoff would have to been for one of the qualifying reasons. More guidance likely to follow.

Employee Retention Credit for Employers Subject to Closure Due to COVID-19

This provision provides a payroll tax credit of 50% for wages paid to employees during the COVID-19 crisis. The key components of this benefit are as follows:

- Eligible employers are those with less than 100 employees

- Credit is provided through December 31, 2020

- For purposes of this benefit, wages are limited to gross wages plus expenses for a qualified health plan as defined by Section 5000(b)(1) of the IRS Code. There is no penalty for furloughed employees.

- The credit is available to employers:

- Whose operations were fully or partially suspended due to a COVID-19 related shut-down order from a State or Federal agency

- Whose gross receipts declined by more than 50 percent when compared to the same quarter in the prior year

- Reportable wages cannot exceed what the employee would have been paid based on wages for the period 30 days prior to any reporting period.

- The credit cannot be taken if the employer has taken out a PPP loan from the SBA.

To be eligible to enter this tax credit program, your gross receipts must have declined by more than 50% comparing your current 2020 quarter to your 2019 quarter. Once you become eligible, your eligibility stays intact for each subsequent quarter through December 31, 2020 where your gross receipts decline by more than 20% compared to 2019. If you initially qualify, once you have less than a 20% reduction in gross receipts for any quarter, you no longer qualify. The following example demonstrates how this works.

PERIOD GROSS RECEIPTS PAYROLL EXPENSES APPLICATION TO ERTC

Q1 2019 $500,000 $100,000

Q1 2020 $475,000 $90,000 YOU DO NOT QUALIFY

Q2 2019 $500,000 $100,000

Q2 2020 $240,000 (>50%) $ 50,000 YOU QUALIFY FOR $50,000 TAX CREDIT

Q3 2019 $500,000 $100,000

Q3 2020 $350,000 (>20%) $ 70,000 YOU QUALIFY FOR $70,000 TAX CREDIT

Q4 2019 $500,000 $100,000

Q4 2020 $410,000 (<20%) $ 80,000 YOU NO LONGER QUALIFY

> How to obtain Credit: Credit will be applied to taxes you owe. Make sure your accountant is well versed in this program.

Delay of Payment of Employer Payroll Taxes

Under this provision, employers and self-employed individuals are allowed to defer payment of the employer share of the FICA tax they otherwise are responsible for paying. This is not tax obligation forgiveness, only a delay in payment if you choose to. Payment of delayed tax obligations will be required with half of the amount required by December 31, 2021 and the other half by December 31, 2022. This deferral is not an option if you are receiving assistance through a PPP loan.

> How to obtain Credit: Deferral may be applied to taxes you owe. Make sure your accountant is well versed in this program.

Public Health and Social Services Emergency Fund

This is an HHS program for eligible health care providers, including optometrists. Funds will be made available for health care related expenses or lost revenues attributable to coronavirus that are not otherwise reimbursed under other programs in the Act. This benefit is only available to Medicare or Medicaid enrolled providers. Details of the plan will be developed by HHS.

Business Losses

Special classification and amounts of business loss due to adverse effects from the coronavirus crisis will be developed. There are also special provision related to advanced minimum tax calculations. The details of this should be discussed with your accountant.

CHANGES IN HEALTH CARE DELIVERY

Expanding Flexibility in Provision of Telehealth to Medicare Beneficiaries

This expansion would allow doctors, including optometrists, to provide telehealth services to both established and new patients. State laws may not allow optometrists or any physician to perform telehealth on patients without an established doctor/patient relationship so check with the State Board.

The Act also establishes grant programs and directives to Congress to gather reports on ways to improve and enhance telehealth services. It also specifically charges HHS to consider ways to increase use of telehealth services, especially for home health care.

Medicare Sequester Suspended

This provision temporarily lifts the 2% Medicare sequester on all payments to doctors of optometry and other Medicare providers. The sequester will apply to the period May 1, 2020 to December 31, 2020.

Small Health Care Provider Quality Improvement Grant Program

This provision provides for optometrists access to grants designed to improve care in small health care practices. Grants would be funded to develop better ways for optometrists to increase communication and coordination of care with other health care providers with the ultimate goal of improving patient health outcomes. The grant period will be five years.

United States Public Health Service Modernization

This provision is designed to develop ways to increase training of doctors including optometrists, nurses and allied health personnel to ensure an adequate access to care even during public health emergencies

Elimination of Liability for Volunteer Healthcare Efforts

The act eliminates claims of liability against health care professionals acting within scope of practice as a volunteer for care related to COVID-19.

PROVIDER RELIEF FUND

The CARES Act provides $100 billion in relief funds to hospitals and other healthcare providers on the front lines of the coronavirus response. This funding will be used to support healthcare-related expenses or lost revenue attributable to COVID-19 and to ensure uninsured Americans can get testing and treatment for COVID-19. $100 billion was designated for this relief fund and only $30 billion was distributed in the first round. You are eligible if:

- You received Medicare reimbursements in 2019 (excludes Part C Advantage plans), and;

- You are in good standing with CMS, and;

- You attest that you have provided diagnosis, testing or care for individuals with possible or actual COVID-19.

You do nothing to receive these funds. Disbursement of funds is being handled by UnitedHealth Group. If you participate in an auto-deposit program for Medicare reimbursement, the funds will be automatically deposited in your bank account – they are likely already there. If you do not, you will receive a check in the mail within a few weeks.

Funds are based on a formula that considers how much you were reimbursed by CMS in 2019. The funds are accounted to the TIN of the individual provider or group (groups will receive one amount that includes the relief funds for all the providers in the group including employed providers). Providers receiving relief funds will need to agree to the Relief Fund Payment Terms and Conditions https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/terms-conditions/index.html.

Providers will need to attestation and agree to the terms.

If you have direct deposit of reimbursement and have not received funds or if you do not receive a check in a few weeks, you can call 1-877-620-6194. Press one (1) when they start talking and you will be connected to an agent. You will need to provide your tax ID number for an agent to give you the status of your payment.

HHS will begin distribution of the remaining $20 billion of the general distribution to these providers on April 24 to augment their allocation so that the whole $50 billion general distribution is allocated proportional to providers’ share of 2018 net patient revenue.

On April 24, a portion of providers will automatically be sent an advance payment based off the revenue data they submit in CMS cost reports. Providers without adequate cost report data on file will need to submit their revenue information to the General Distribution Portal for additional general distribution funds.

STUDENT LOAN RELIEF

Requires the Federal Government to allow the following to assist those with student debt.

- Defer for student loan payments, principal, and interest for 6 months, through September 30, 2020 without any additional penalties

- Includes optometry students

- Stops any collection efforts due to non-payment during the period that the payments are suspended.

- Allows student loan repayment contributions from employers to not be counted as taxable income – up to a cap of $5.250 for contributions made prior to January 1, 2021

INDIVIDUAL ASSISTANCE PROGRAMS

The CARES Act provides several benefits related to applicable individuals.

Unemployment Assistance

In addition to funds to assist in processing and payment of the increase in unemployment claims, the following changes are made.

Extends unemployment benefits for individuals (who are otherwise capable of working) for the following reasons:

- They are diagnosed with COVID-19

- Someone in their house is diagnosed with COVID-19

- Providing care to a child at home because their school closed or lack of paid childcare

- Is under a quarantine imposed by a Federal or State agency or a physician

- An individual who cannot reach their job due to complications from COVID-19

- An individual who has become a primary breadwinner due to the COVID-19 related death of primary head of the household

- Individual who quit their job as a result of fear of contracting COVID-19

- Individual’s place of employment is closed due to issues related to COVID-19

- Coverage for this extension of benefits is limited to 39 weeks and is for the covered period January 27, 2020 thru December 31, 2020

- States may enter into an agreement with the Secretary of Labor that will provide for an additional $600 per week (the Federal Pandemic Unemployment Compensation) above the rate standard benefit calculation

Benefits under this Act are extended to most business owners as well as independent contractors (with a more complex compensation determination). The requirement that individuals approved for unemployment benefits be actively seeking employment is waived if unemployment compensation granted under this Act. Individuals who provide fraudulent information regarding their qualifications under this rule are subject to prosecution and removal from eligibility of unemployment compensation under this act. There are also options for emergency unemployment benefits for individuals who have otherwise exhausted all available unemployment compensation.

RECENT NEWS: The exemptions under this Pandemic Unemployment benefit under CARES is further defined to include almost any individual whose business is closed or has suffered significant reduction in income. This includes owners of corporations paid exclusively by distribution (K-1). Owners of corporations who classify themselves as employees and receive W-2 wages are already included. The manner in which the unemployment system will process these unique requests is unknown at this time.

Recovery Rebates

Tax credits for the year 2019 for eligible individuals in the amount of:

- $1200 individual

- $2400 joint return

- $500 for each qualifying child

The credit amount will be reduced (not below zero) by 5% of the amount for the following adjusted gross incomes:

- $112,500 individual

- $150,000 head of household

- $75,000 any taxpayer not falling under #1 or #2

Retirement Plans

This provision addresses special tax implications for withdrawals from and loans from retirement plans related to expenses from COVID-19. These would be allowed and subject to tax paid over a three year period unless funds are recontributed.

The law also allows waivers for mandatory disbursement from certain retirement plans.

Miscellaneous Benefits

Miscellaneous benefits include:

- Moratorium on adverse credit reporting for individuals effected by COVID-19 crisis cannot make payment obligations. This is effective January 1 2020 and extends 120 days after the President calls off the National Emergency.

- Moratorium on foreclosures against individuals effected by COVID-19 crisis regardless of delinquency status for up to 180 days with ability to extend another 180 days.

- Requires Part D plans to allow most any Rx for 90-day supply at patients request.

- Menstrual products reclassified as medical products for IRS deduction determination.

- Special provisions allow for restructuring of bankruptcy agreements made prior to March 27, 2020.

SPECIAL NOTES REGARDING CARES

This expansive piece of legislation contains other provisions not related to the coronavirus crisis. Examples include:

- 95 pages of regulations allowing significant increased authority of HHS and FDA over OTC drugs with ability to impose significant taxation on facilities manufacturing certain OTC drugs

- Hundreds of billions designated to increase funding to Federal and State agencies related to increased costs with dealing with corona virus crisis. For example, it provides an additional amount for ‘‘National Network for Grants to the National Railroad Passenger Corporation’’, $526,000,000, to remain available until expended, to prevent, prepare for, and respond to coronavirus.

The final bill can be found here: https://www.congress.gov/bill/116th-congress/house-bill/748/text#toc-HCCF2DA7CBD6341059EAB97C24489743B

FAMILIES FIRST CORONAVIRUS RESPONSE ACT (FFCRA)

Congress passed emergency legislation (HR 6021) that allows for additional benefits to employees in this crisis. Eligibility for these benefits is restricted to issues related to the COVID-19 crisis. We expect additional guidance and clarification on many issues related to FFCRA. There are three main elements related to most of you.

Unemployment Compensation

Funding was significantly increased for operations and benefits under the unemployment benefit program. Funding will be provided only to states that meet certain requirements. Employees who are laid off are definitely eligible for this benefit. Employees who have their hours reduced are also eligible – how much reduced and for how long are typically state specific rules each affected employee will have to deal with. Application and processing rules for these benefits are likely to be significantly reduced. Employers need to take no additional or different action related to these changes. For employee accessed unemployment benefits under this Act, the employer will not be levied any penalty of adjustment in their unemployment tax rate. See Employment Assistance under the CARES Act for information on how that legislation also effects unemployment benefits

Paid Sick Leave

This benefit is a ten (10) day paid sick leave benefit for employees for any one of the following reasons:

- Employee is ordered by federal or state order or directed by a physician to isolate or quarantine

- Employee is symptomatic and seeking a diagnosis from a physician

- Employee who needs time to care for a child due to closure of school or loss of access to childcare

- Any other similar situation related to the corona crisis – not yet fully defined

Payment of this benefit for reasons 1 and 2 are paid at the employee’s regular rate of pay with a cap of $511 per day or $5,110 for the entire ten days. Payment of this benefit for the third reason must be at a rate that is at least two-thirds of their usual rate of pay with a cap of $200 per day and a $2,000 aggregate. For salaried employees, you can calculate their applicable hourly rate of pay by dividing their salary by 2080 (ex. You pay your Administrator $70,000 a year – $70,000 / 2080 = applicable hourly rate of $33.65).

FMLA Extension

An extension to the Family Medical Leave Act allows for twelve (12) weeks of paid leave if the employee has to leave work in order to take care of a child due to the fact their child’s school is closed or child care not available. The employee must have exhausted ALL their paid sick leave related to this Act before they can access the FMLA extension benefit. This means the FMLA extension is actually for only ten (10) weeks and could not be accessed prior to April 11, 2020. The actual number of hours that time represents is based on the employee’s usual work schedule prior to the crisis date of February 15, 2020. For example, if an employee normally works 40 hours a week, they would be entitled to the full 400 hours of paid leave. If they work less than that, it would be based on their average weekly hours worked times the ten weeks. In order to qualify for this benefit, the employee must have worked 30 days prior to April 1, 2020. This is paid at a minimum of 2/3 of the employee’s normal wages. Specific to the FMLA extension benefit, this extension only applies to the childcare/school reason and not just because you have to lessen an employee’s hours or lay them off completely due to the economic turndown. Employers may also exclude employed doctors from this benefit.

Issues Common to Both Paid Sick Leave and the FMLA Extension

- Access to Paid Sick Leave starts on April 1, 2020 and to FMLA extension leave on April 11, 2020. The covered period for both benefits extends to December 31, 2020. Employees have access to these benefits ONLY during the period of time they are your employee AFTER April 1, 2020 THRU December 31, 2020. If you lay your employees off prior to April 1, 2020, they are not eligible to access these benefits until you hire them back.

- Paid Sick leave and FMLA extension leave can be taken intermittently but only if the employer agrees to it.

- The employee must have exhausted all Paid Sick Leave before they can access the FMLA extension leave.

- Both of these benefits are IN ADDITION to any paid time off you provide. While the employee is free to use accrued paid time off you have provided instead of accessing these two benefits, you may not require them to do so.

- The Department of Labor allows healthcare providers (including optometrists) to exempt their employees from both the Paid Sick Leave and FMLA extension benefits. In this ruling, the Department encourages healthcare providers to be very mindful of the consequences of those decisions. If you elect to deny benefit access, you can still provide whatever assistance you wish even changes in your HR Employee manual policies specific for this crisis.

- The Department of Labor also states small businesses (less than 50 employees) may also be exempt from both of these programs where the employer feels providing these benefits would jeopardize the viability of their business. This decision must be based on one of the following criteria:

- The resultant expenses related to providing the benefits would be in excess of the expected revenue during the applicable time period

- The absence of any individual or all employees would be a substantial risk for continued operations of the business

- Allowance would reduce the work force to unacceptable levels.

Recent News

A clarification by the Department of Labor makes two points clear. First, a qualifying event must take place AFTER April 1 as the law is not in effect until then. Second, the original language states that health care providers could be excluded from the mandate to provide these benefits at their discretion. It was not clear who was included in the definition of health care provider but the recent update makes it clear optometrists are considered under this definition.

Exactly how this will work out is yet to be fully defined but remember these benefits have application limited to the COVID-19 crisis. The point is the choice of how you handle your employees is mostly still in your hands. Whatever you do, remember these actions can be a dangerous precedent and it must be clear the action is totally restricted to the current COVID-19 situation.